2020 Consolidated

Non-financial Statement

Highlights of the main sustainability results achieved in 2020

President’s and CEO’s message President’s and CEO’s message

Group value and solidity Group value and solidity

Governance|Risk management Governance and risk management

Society Society

People People

Environment|Climate Change Environment and Climate Change

SDGs SDGs

Download CNFS 2020 Download CNFS 2020

President’s and CEO’s message

"In the context of the extraordinary emergency of 2020, Intesa Sanpaolo, relying on its financial strength, confirmed its ability to fulfil its role as a social accelerator by actively supporting the country in managing the impact of an extremely severe health, economic and social crisis through a strategy centred around sustainability.

This situation was the backdrop behind the merger with the UBI Banca Group, which contributed to strengthening Intesa Sanpaolo's role for sustainable and inclusive growth, also thanks to the sharing of common values between the two companies.

This form aims to serve as an evidence of the strong commitment made by the Group on sustainability issues, enhancing the numerous initiatives and results achieved albeit in a context of exceptional complexity such as that unfolding in 2020."

Gian Maria Gros-Pietro, President of Intesa Sanpaolo

Carlo Messina, CEO of Intesa Sanpaolo

Group value and solidity

With a strong balance sheet and a leading position, the Group fulfils customers’ requests for credit and responsibly manages savings, aiming to confirm its leadership as a Bank of the real economy, supporting households and businesses.

Economic value breakdown

The economic value generated in 2020, equal to €19,490m, is up compared to 2019. In both financial years the dividend policy was defined in accordance with the recommendations of the European Central Bank of 15 December 2020 - valid until 30 September 2021 - on dividend distributions during the COVID-19 pandemic.

Economic value breakdown

The economic value generated in 2020, equal to €19,490m, is up compared to 2019. In both financial years the dividend policy was defined in accordance with the recommendations of the European Central Bank of 15 December 2020 - valid until 30 September 2021 - on dividend distributions during the COVID-19 pandemic.

€ m / %

€ m / %

New medium/long-term credit granted to the real economy

The role of support to Italy’s real economy is confirmed: of the €87bn of new medium/long-term loans disbursed in 2020 (€105bn including UBI Banca), €77bn were disbursed in Italy, €63bn of which to families and SMEs.

These results are made possible by the Bank's ability to maintain resilient profitability over time, with growing levels of efficiency, together with one of the highest capital strengths in the European banking sector.

Intesa Sanpaolo Group

(excluding UBI Banca)

€ bn

New medium/long-term credit granted to the real economy

The role of support to Italy’s real economy is confirmed: of the €87bn of new medium/long-term loans disbursed in 2020 (€105bn including UBI Banca), €77bn were disbursed in Italy, €63bn of which to families and SMEs.

These results are made possible by the Bank's ability to maintain resilient profitability over time, with growing levels of efficiency, together with one of the highest capital strengths in the European banking sector.

Governance and risk management

The strategic guidelines and policies on sustainability are approved by the Board of Directors with the support of the Risks Committee, taking into account the objectives of solid and sustainable creation and distribution of value for all stakeholders. With the same aim, the Group has implemented specific processes and responsibilities to understand and manage risks in such a way as to ensure long-term soundness and business continuity.

Sustainability Governance

The main ESG responsibilities of the Intesa Sanpaolo Bodies and Structures are specified in this chart.

The ISP4ESG Program continued in 2020. It is a wide-ranging and high-impact program, promoted in 2019 by the CFO in coordination with the Strategic Support Department. It involves all the different Group structures and aims to integrate ESG logics into the Bank's business model and strategy.

With the ISP4ESG Program, Intesa Sanpaolo is committed to generating a concrete impact within the company and on society. Among the pillars of the project: the sector mapping of the Group's loan portfolio from an ESG perspective, the establishment of a Control Room, with the simultaneous appointment of Sustainability Managers to coordinate and evaluate transversal ESG project, the launch of the Sustainable Investments process and the dissemination of the ESG culture both among Group employees and by transferring their knowledge outside, particularly among customers.

The main ESG responsibilities of the Intesa Sanpaolo Bodies and Structures are specified in this chart.

The ISP4ESG Program continued in 2020. It is a wide-ranging and high-impact program, promoted in 2019 by the CFO in coordination with the Strategic Support Department. It involves all the different Group structures and aims to integrate ESG logics into the Bank's business model and strategy.

With the ISP4ESG Program, Intesa Sanpaolo is committed to generating a concrete impact within the company and on society. Among the pillars of the project: the sector mapping of the Group's loan portfolio from an ESG perspective, the establishment of a Control Room, with the simultaneous appointment of Sustainability Managers to coordinate and evaluate transversal ESG project, the launch of the Sustainable Investments process and the dissemination of the ESG culture both among Group employees and by transferring their knowledge outside, particularly among customers.

Risk management

The need to detect, together with the typical risks, an ever more complex set of ESG (environmental, social and governance) risks significant for the possible impact generated or suffered by the company's activities and the related mitigation actions, is increasingly consolidated. These are, i.e., risks related to the failure to safeguard the environment, human rights, and correct operating practices also in customer activities and along the procurement chain.

Integrity in corporate conduct

Training to prevent corruption and money laundering

Training increasing well beyond the minimum levels established by law in a field that is particularly delicate, also from a reputational perspective. The Group’s anti-corruption management system is certified according to the UNI ISO 37001 international standards.

The Group's continuous effort to manage this particularly sensitive area is confirmed: over the last three years there were no cases of corruption-related dismissals or disciplinary actions among Group workers.

Intesa Sanpaolo Group

(excluding UBI Banca)

no. hours provided

Training to prevent corruption and money laundering

Training increasing well beyond the minimum levels established by law in a field that is particularly delicate, also from a reputational perspective. The Group’s anti-corruption management system is certified according to the UNI ISO 37001 international standards.

The Group's continuous effort to manage this particularly sensitive area is confirmed: over the last three years there were no cases of corruption-related dismissals or disciplinary actions among Group workers.

Consumer protection training

Increasing investments on training on consumer protection: 61,700 employees trained (72% of total).

Consumer protection training

Increasing investments on training on consumer protection: 61,700 employees trained (72% of total).

Intesa Sanpaolo Group

(excluding UBI Banca)

no. hours provided

Human rights

Intesa Sanpaolo, in addition to complying with the legislative frameworks of all the countries where it operates, is committed to identify, mitigate and, where possible, prevent potential human rights violations linked to its activities, as required under the latest United Nations Guiding Principles on Business and Human Rights.

In this context, a specific Group policy on human rights was approved in December 2017, taking up and developing the principles already present in the Code of Ethics and considering its impact on Group employees, customers, suppliers and the community. The environment is another issue closely related to the principles of human rights, and the promotion of high environmental standards must therefore be considered key to respecting and enjoying these rights.

Society

Intesa Sanpaolo attributes a key role to projects focused on the economic, social, cultural and civil growth of the communities in which it operates: financing the real economy, supporting those in need and the Third Sector, sustainable investments and investments in innovation, and promoting Italy’s artistic heritage are long-standing commitments and an indelible part of the Group’s history and business approach.

Quality of service and customer satisfaction

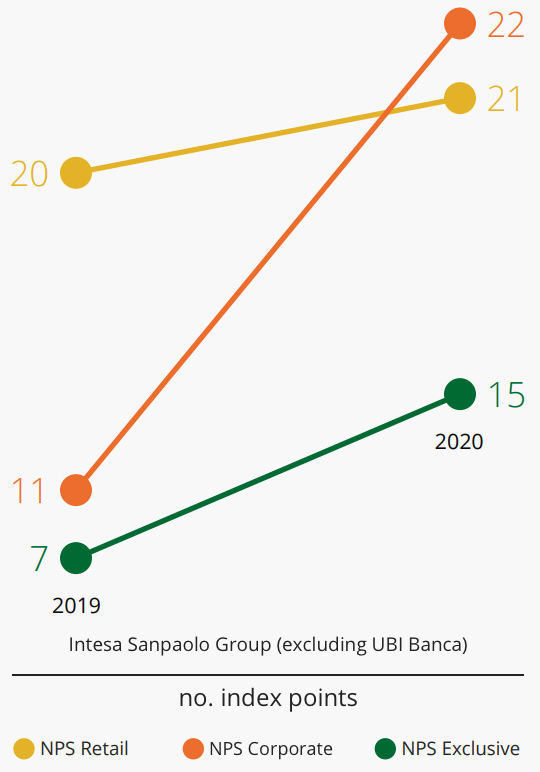

Net Promoter Score – customer satisfaction

The NPS* indicator is improved compared with 2019 as result of the strengthening of the Bank/customer relationship, also positively influenced by opinions on Intesa Sanpaolo’s conduct during the health emergency: over 70% of interviewed customers felt that the Bank paid the right level of attention to customers’ needs, about 80% believe that the Bank met Italy’s needs and lastly over 80% felt that the safety measures taken in Branches were adequate. For the Corporate segment, the indicator was affected in 2019 by the change in the service model (change of branch and/or manager) and improved significantly as a result of the full application of the new model.

*NPS is an indicator that expresses the likelihood of customers to recommend the bank, therefore its overall satisfaction. During 2020, about 750,000 customers were interviewed.

Net Promoter Score – customer satisfaction

The NPS* indicator is improved compared with 2019 as result of the strengthening of the Bank/customer relationship, also positively influenced by opinions on Intesa Sanpaolo’s conduct during the health emergency: over 70% of interviewed customers felt that the Bank paid the right level of attention to customers’ needs, about 80% believe that the Bank met Italy’s needs and lastly over 80% felt that the safety measures taken in Branches were adequate. For the Corporate segment, the indicator was affected in 2019 by the change in the service model (change of branch and/or manager) and improved significantly as a result of the full application of the new model.

*NPS is an indicator that expresses the likelihood of customers to recommend the bank, therefore its overall satisfaction. During 2020, about 750,000 customers were interviewed.

Innovation and digital transformation

Multichannel banking in Italy

European leader for its mobile app functionalities and strong digital solutions: +1.1m of multichannel customers, 6.5m customers that use the Group’s apps, sharp increase in the sales of products on digital channels, equal to over 2m contracts in 2020 (+182% compared to 2019).

Multichannel banking in Italy

European leader for its mobile app functionalities and strong digital solutions: +1.1m of multichannel customers, 6.5m customers that use the Group’s apps, sharp increase in the sales of products on digital channels, equal to over 2m contracts in 2020 (+182% compared to 2019).

(excluding UBI Banca)

Multichannel customers

m / %

Multichannel customers out of total

m / %

Financial inclusion and supporting production

Loans disbursed for initiatives with high social impact

High social impact financing represents 42.5% of all loans granted by the Group (vs. 6.6% in 2019). The trend is growing strongly for loans issued to support families and businesses during the COVID-19 emergency (€31.9bn of which almost €30bn as part of the “Liquidity Decree”).

Intesa Sanpaolo Group

(excluding UBI Banca)

€ bn / % on loans

Loans disbursed for initiatives with high social impact

High social impact financing represents 42.5% of all loans granted by the Group (vs. 6.6% in 2019). The trend is growing strongly for loans issued to support families and businesses during the COVID-19 emergency (€31.9bn of which almost €30bn as part of the “Liquidity Decree”).

Fund for Impact

Plafond to grant credit to excluded individuals or to those who are unlikely to access credit through traditional financial channels. It includes:

• per Merito, the first unsecured credit line dedicated to all university students residing in

Italy and studying in Italy or abroad

• XME StudioStation, which provides loans to families to support distance learning

• MAMMA@WORK, loan at highly advantageous rates to reconcile motherhood and work in the first years of children’s life

Two other new initiatives were announced to support working mothers in India and people over 50 who have lost their jobs or have difficulty accessing pension schemes.

Fund for Impact

Plafond to grant credit to excluded individuals or to those who are unlikely to access credit through traditional financial channels. It includes:

• per Merito, the first unsecured credit line dedicated to all university students residing in

Italy and studying in Italy or abroad

• XME StudioStation, which provides loans to families to support distance learning

• MAMMA@WORK, loan at highly advantageous rates to reconcile motherhood and work in the first years of children’s life

Two other new initiatives were announced to support working mothers in India and people over 50 who have lost their jobs or have difficulty accessing pension schemes.

€51.5 m

granted in 2020

€90.6 m

granted since the beginning 2019

per Merito: loans granted

€1.2 m

granted in 2020

per Merito: loans granted

XME StudioStation: granted (€ m granted)

Sustainable investments and insurance

Sustainable investments

Principles for Responsible Investment – PRI

Intesa Sanpaolo Group adheres to the PRI - principles on the integration of ESG criteria into investments, born from the partnership between UNEP FI and the Global Compact - as a signatory through Eurizon Capital SGR, the Group Pension Fund, Fideuram Asset Management SGR and Fideuram Asset Management (Ireland).

Principles for Responsible Investment – PRI

Intesa Sanpaolo Group adheres to the PRI - principles on the integration of ESG criteria into investments, born from the partnership between UNEP FI and the Global Compact - as a signatory through Eurizon Capital SGR, the Group Pension Fund, Fideuram Asset Management SGR and Fideuram Asset Management (Ireland).

Ethical/ESG Funds

The leadership in sustainable investments in Italy is confirmed, with an overall market share of 22.8% (30.4% including UBI Banca). Group’s net inflows increased significantly to €8.4bn (over €9bn in 2020 considering UBI Banca), compared to €2bn in 2019.

Ethical/ESG Funds

The leadership in sustainable investments in Italy is confirmed, with an overall market share of 22.8% (30.4% including UBI Banca). Group’s net inflows increased significantly to €8.4bn (over €9bn in 2020 considering UBI Banca), compared to €2bn in 2019.

Eurizon

Fideuram

Intesa Sanpaolo Group (excluding UBI Banca)

€ m

Pramerica

UBI Banca

Gruppo

Intesa Sanpaolo Group

(excluding UBI Banca)

UBI Banca

€ m

Sustainable insurance

UNEP Finance Initiative – Principles for Sustainable Insurance – PSI

As part of a more general integration path of sustainability into business logics and strategies, the Intesa Sanpaolo Vita Insurance Group has joined the Principles for Sustainable Insurance (PSI) promoted by the United Nations.

UNEP Finance Initiative – Principles for Sustainable Insurance – PSI

As part of a more general integration path of sustainability into business logics and strategies, the Intesa Sanpaolo Vita Insurance Group has joined the Principles for Sustainable Insurance (PSI) promoted by the United Nations.

Sustainability Policy – Insurance

In January 2021, a Sustainability Policy came into force which, at an Insurance Group level, starting from the SDGs, defines the guidelines to promote a responsible and sustainable business model. It formalizes the roles of the Board of Directors and the company structures involved in the management of sustainability issues and risks.

Community support

Monetary contribution to the community

Strong growth in contributions (+114% compared to 2019) due to the Group’s immediate support to the health sector to help with the extraordinary COVID-19 emergency, which has impacted very hard on families, businesses and society as a whole. The most high-profile operations included the €120m donated to strengthen the national health system.

Monetary contribution to the community

Strong growth in contributions (+114% compared to 2019) due to the Group’s immediate support to the health sector to help with the extraordinary COVID-19 emergency, which has impacted very hard on families, businesses and society as a whole. The most high-profile operations included the €120m donated to strengthen the national health system.

Intesa Sanpaolo Group

(excluding UBI Banca)

€ m

Food and Shelter Program for people in need

The project forms part of the initiatives to reduce child poverty and support people in need, the targets for which were reached in advance compared with the 2018-2021 Business Plan goal.

clothing

8.7m

16.1m

519,000

994,000

131,000

228,000

103,000

178,000

no. - cumulative value since the beginning of 2018

The Gallerie d’Italia, internationally renowned as Italian centres of cultural excellence, host the Bank’s collections, temporary exhibitions in partnership with leading international museums, and free activities for students and vulnerable categories.

...and the fourth (next opening) in Turin in Piazza San Carlo, which will be dedicated to photography and digital world

Giovani e Lavoro Program

The program, in partnership with Generation Italy, is geared towards the training and inclusion of 5,000 young people in the Italian employment market over a multiyear period.

Giovani e Lavoro Program

The program, in partnership with Generation Italy, is geared towards the training and inclusion of 5,000 young people in the Italian employment market over a multiyear period.

aged 18-29 submitted

applications in 2020

(over 15,000 since 2019)

interviewed and ~740

students trained/undergoing

training

through 33 courses in 2020

involved since the beginning of the Program

People

The Business Plan 2018-2021, in line with the previous one, identifies the Group people as key for the consolidation and continuing growth of the Bank. The objectives that Intesa Sanpaolo has set itself can only be achieved with a high professionalism and a conscious motivation of the people who work there.

Employment protection

People reassigned to high value-added activities

At the end of 2020, about 4,500 people were already re-focused on priority initiatives, through professional retraining actions, compared with a target of 5,000 by 2021.

For Intesa Sanpaolo, the protection of employment is a priority theme to guarantee economic solidity in the medium to long term and is one of the elements that also characterizes the 2018-2021 Business Plan.

Intesa Sanpaolo Group

(excluding UBI Banca)

no.

People reassigned to high value-added activities

At the end of 2020, about 4,500 people were already re-focused on priority initiatives, through professional retraining actions, compared with a target of 5,000 by 2021.

For Intesa Sanpaolo, the protection of employment is a priority theme to guarantee economic solidity in the medium to long term and is one of the elements that also characterizes the 2018-2021 Business Plan.

Retention, enhancement, diversity and inclusion of the Group’s people

Training

Around 11 million of hours of distance learning: the pandemic had a great impact on the way of working but, also thanks to digital technology, it was possible to quickly re-organise remote activities, launching communication campaigns to encourage flexible training.

Training

Around 11 million of hours of distance learning: the pandemic had a great impact on the way of working but, also thanks to digital technology, it was possible to quickly re-organise remote activities, launching communication campaigns to encourage flexible training.

Intesa Sanpaolo Group

(excluding UBI Banca)

m hours provided

Diversity Management

The Diversity & Inclusion Structure (D&I) within Chief Operating Officer Governance Area, promotes an inclusive working environment, able to welcome and enhance all forms of diversity, in line with the strategy outlined during 2019, continued source of inspiration and method.

The Diversity & Inclusion Principles were approved in 2020. The policy expresses the Group's inclusion policy towards all forms of diversity and is based on respect for all people, meritocracy and equal opportunities.

Employees by category and gender

With a constant trend in the breakdown by category and gender, there was a slight growth in female managers (executives and middle management), equal to 40% of management and 28.6% of the entire female population.

To continue to raise awareness among managers on the theme of enhancing female talent, a dedicated KPI has been included in the performance sheets of more than 1,200 managers this year, with a direct impact equal to 10% of the incentive system.

% Men

% Women

Executives

Middle managers

Professional areas

Intesa Sanpaolo Group (excluding UBI Banca)

% Men

% Women

Executives

Middle managers

Professional areas

ISP + UBI

% Men

% Women

Employees by category and gender

With a constant trend in the breakdown by category and gender, there was a slight growth in female managers (executives and middle management), equal to 40% of management and 28.6% of the entire female population.

To continue to raise awareness among managers on the theme of enhancing female talent, a dedicated KPI has been included in the performance sheets of more than 1,200 managers this year, with a direct impact equal to 10% of the incentive system.

Health, safety and well-being of the Group’s people

Smart working

People and digital technology represent the key enablers in the 2018-21 Intesa Sanpaolo Business Plan. In the context of COVID-19, in 2020, the Group guaranteed safe working conditions for its people, accelerating the digitalisation of its operations and employing digital coaches to support the transition to smart working and share best practices.

Smart working

People and digital technology represent the key enablers in the 2018-21 Intesa Sanpaolo Business Plan. In the context of COVID-19, in 2020, the Group guaranteed safe working conditions for its people, accelerating the digitalisation of its operations and employing digital coaches to support the transition to smart working and share best practices.

Intesa Sanpaolo Group

(excluding UBI Banca)

no. Participants

Health and safety

In the context of COVID-19, the Group promptly ensured safe working conditions by accelerating digitalization and through specific initiatives for the prevention of infections and to support people's well-being:

• sanitary hygiene standards and sanitary devices

• voluntary flu and anti-pneumococcal vaccination campaign (17,493 flu vaccines and 7,575 anti-pneumococcal vaccines administered)

• initiatives such as Consultation and Support, a service that provides free psychological support, and Carelab, an integrated system of content and tools focused on diets, exercise, energy and emotional well-being

Environment and Climate Change

Intesa Sanpaolo considers the environment - and climate change in particular - as key issues, integrated in a wider social and environmental strategy that includes the integration of sustainability in all the Group's departments and banks.

Transition to a sustainable, green and circular economy

Loans disbursed for the Green and Circular Economy

More than €2.5bn of disbursements for the Green and Circular Economy, equal to 2.9% of all Group's loans, of which €130m under the new S-Loan initiative launched in July 2020.

S-Loan is an innovative solution aimed at SMEs to finance projects that improve their sustainability profile. The loans enjoy reduced rates, subject to the annual monitoring of two ESG KPI, which must be reported in the company’s financial statements. €2bn has been allocated to this initiative as part of the €50bn green economy.

Loans disbursed for the Green and Circular Economy

More than €2.5bn of disbursements for the Green and Circular Economy, equal to 2.9% of all Group's loans, of which €130m under the new S-Loan initiative launched in July 2020.

S-Loan is an innovative solution aimed at SMEs to finance projects that improve their sustainability profile. The loans enjoy reduced rates, subject to the annual monitoring of two ESG KPI, which must be reported in the company’s financial statements. €2bn has been allocated to this initiative as part of the €50bn green economy.

€ mln erogati

Green Economy

€ mln erogati criteri

Circular Economy

Intesa Sanpaolo Group

(excluding UBI Banca)

2020

€ mln erogati

Green Economy

€ mln erogati criteri

Circular Economy

Circular Economy

The Intesa Sanpaolo Group promotes the dissemination of this model also with the support of the Ellen MacArthur Foundation, the main promoter of the global transition to the Circular Economy, of which Intesa Sanpaolo was confirmed as Global Partner for the three-year period 2019-2021.

During the 2018-2021 Business Plan, the Group has made available a plafond dedicated to the Circular Economy. In 2020 the Plafond was extended to support businesses that invest in green projects in the area of renewable energy production, energy efficiency and sustainable farming and biodiversity, and to support the Green Mortgages requested by customers for the purchase of new high energy efficiency houses (class B upwards) or the refurbishment of houses with consequent improvement of the energy class.

Intesa Sanpaolo Group

(excluding UBI Banca)

Circular Economy Plafond Projects*:

% amounts disbursed by sector in 2020

* Green Mortages excluded

Intesa Sanpaolo Group (excluding UBI Banca)

Circular Economy Plafond Projects*:

% amounts disbursed by sector in 2020

* Green Mortages excluded

Circular Economy

The Intesa Sanpaolo Group promotes the dissemination of this model also with the support of the Ellen MacArthur Foundation, the main promoter of the global transition to the Circular Economy, of which Intesa Sanpaolo was confirmed as Global Partner for the three-year period 2019-2021.

During the 2018-2021 Business Plan, the Group has made available a plafond dedicated to the Circular Economy. In 2020 the Plafond was extended to support businesses that invest in green projects in the area of renewable energy production, energy efficiency and sustainable farming and biodiversity, and to support the Green Mortgages requested by customers for the purchase of new high energy efficiency houses (class B upwards) or the refurbishment of houses with consequent improvement of the energy class.

Circular Economy Plafond Projects*:

% amounts disbursed by sector in 2020

* Green Mortages excluded

(excluding UBI Banca)

Disbursed in 2020

Disbursed since the launch of the Plafond

€1,446m

Disbursed in 2020

Intesa Sanpaolo Group

(excluding UBI Banca)

€2,206m

Disbursed since the launch of the Plafond

€1,474m

Disbursed in 2020

€2,234m

Disbursed since the launch of the Plafond

Circular Economy Plafond: loans disbursed € m

Green Bond

Intesa Sanpaolo's commitment to the Green Economy is also implemented through the issue of bonds dedicated to the financing of environmental sustainability projects. It was the first Italian Bank to issue a Green Bond worth €500m in 2017 to finance renewable energy and energy efficiency projects in particular. In November 2019, it issued its first Circular Economy-focused Green Bond of €750m, intended to support the Bank's loans under the plafond dedicated to the Circular Economy.

Direct environmental impacts

Greenhouse gas emissions

CO2 emissions fell significantly (-13.1% vs. 2019) due to the continuation of planned energy efficiency measures but most of all to the reduced use of the Bank’s buildings from from March 2020 onwards because of the COVID-19 emergency.

Nevertheless, the Bank continued to operate during the lockdown and its premises remained open at all times, albeit with a reduced number of people onsite and restricted opening hours for the branches.

Greenhouse gas emissions

CO2 emissions fell significantly (-13.1% vs. 2019) due to the continuation of planned energy efficiency measures but most of all to the reduced use of the Bank’s buildings from from March 2020 onwards because of the COVID-19 emergency.

Nevertheless, the Bank continued to operate during the lockdown and its premises remained open at all times, albeit with a reduced number of people onsite and restricted opening hours for the branches.

Intesa Sanpaolo Group

(excluding UBI Banca)

Total Tons of CO2 (Scope1 + 2 Market-based)**

**Market-based: for purchased electricity the Scope2 data considers the contribution, agreed contractually, of the guaranteed renewable source certificates, which therefore have zero emissions.

Energy from renewable sources

The purchase and production of renewable energy, albeit in accordance with the limitations imposed by law in some Countries, continues to be one of the main environmental sustainability actions through which the Intesa Sanpaolo Group intends to pursue its goals.

Italy

Group

Intesa Sanpaolo Group (excluding UBI Banca)

% renewable electricity consumption vs total

Group

Intesa Sanpaolo Group

(excluding UBI Banca)

% renewable electricity consumption vs total

Energy from renewable sources

The purchase and production of renewable energy, albeit in accordance with the limitations imposed by law in some Countries, continues to be one of the main environmental sustainability actions through which the Intesa Sanpaolo Group intends to pursue its goals.

SDGs. Intesa Sanpaolo and the United Nations

Sustainable Development Goals

Intesa Sanpaolo adheres to the United Nations Global Compact and recognizes itself in the community of companies that support the 17 Sustainable Development Goals (SDGs), set by the United Nations 2030 Agenda and signed by 193 countries, including Italy, at the end of 2015.